Art Investments

Digital Renaissance: The Evolution of Art Investment Through Online Platforms

Art investment has long been a niche yet lucrative market, attracting collectors and investors who appreciate the dual benefits of owning aesthetically pleasing works while potentially earning substantial financial returns. Traditionally, art investment was reserved for the wealthy elite, facilitated by high-end auction houses and galleries. However, the advent of digital platforms is democratizing this market, making it accessible to a broader audience and transforming how art is bought, sold, and valued.

The Appeal of Art Investment

Art investment is driven by several factors. Art provides an alternative asset class that can diversify investment portfolios, reducing risk and enhancing returns. Art also has a history of appreciating over time, with certain pieces experiencing exponential growth in value. Unlike stocks and bonds, art is a tangible asset that investors can enjoy in their homes or offices. Moreover, owning art can provide a sense of cultural enrichment and emotional satisfaction, beyond financial gains.

Challenges in Traditional Art Investment

Despite its allure, traditional art investment poses several challenges. The cost of acquiring high-quality art pieces can be prohibitively expensive. The art market has historically been opaque, with prices and valuations often shrouded in secrecy. Selling art can be time-consuming and may not always fetch the desired price. Furthermore, verifying the authenticity and provenance of artwork is crucial to avoid forgeries and legal issues.

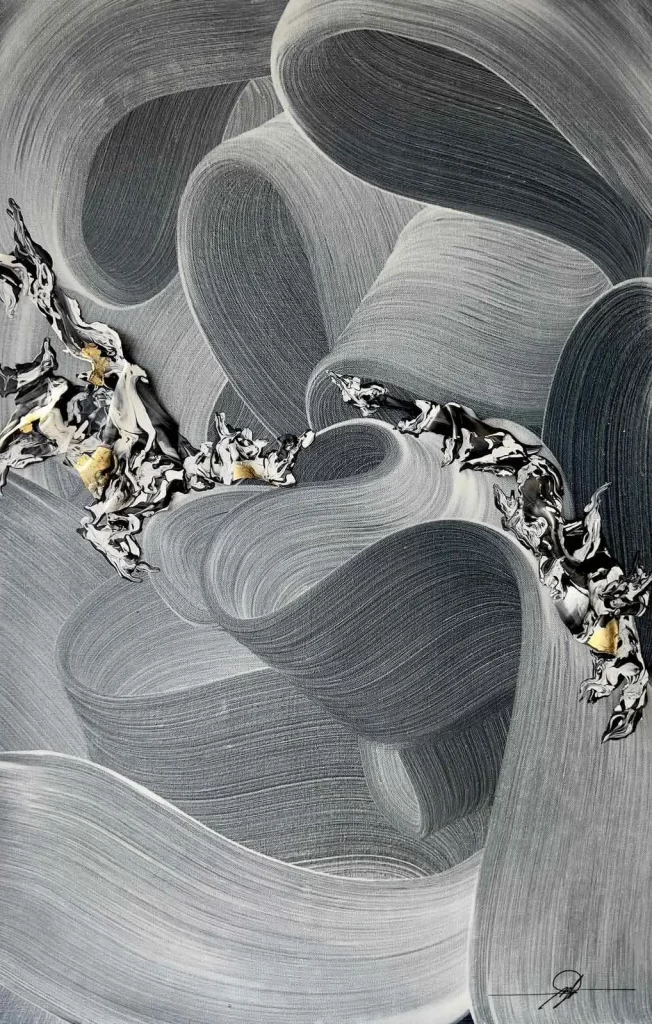

by Roel G. Cabulang

2023, Mixed Media on Canvas, 35.5″ x 21.5″

The Role of Digital Platforms

Digital platforms are addressing these challenges, bringing significant innovations to the art investment landscape. Online marketplaces and platforms have lowered the barriers to entry, allowing more people to invest in art. Fractional ownership platforms enable investors to buy shares in high-value artworks, making art investment more affordable. Digital platforms provide comprehensive data on artwork, including historical prices, artist profiles, and market trends. This transparency helps investors make informed decisions. Secondary markets on digital platforms facilitate the buying and selling of art, enhancing liquidity. Investors can trade shares of art pieces or sell entire works more easily. Additionally, blockchain and other technologies are being used to verify the authenticity and provenance of artworks, reducing the risk of fraud.

Key Digital Platforms in Art Investment

Several digital platforms are leading the way in transforming art investment. Masterworks specializes in fractional ownership, allowing investors to buy shares in blue-chip artworks. Masterworks handles the acquisition, storage, and eventual sale of the pieces. Artnet offers a comprehensive database of auction results, market analytics, and online auctions. It provides valuable insights and tools for art investors. Artory uses blockchain technology to create secure digital records of artwork provenance and ownership, enhancing trust and transparency in the market. Saatchi Art is an online gallery that connects artists with buyers. It offers a wide range of contemporary art, making it accessible to a broader audience.

by Roel G. Cabulang

2023, Mixed Media on Canvas, 35.5″ x 21.5″

The Future of Art Investment

The integration of digital platforms in art investment is poised to grow, driven by several trends. As more investors recognize the benefits of digital platforms, their adoption will likely increase, further democratizing art investment. Continued innovation in technology, particularly blockchain and artificial intelligence, will enhance transparency, security, and valuation accuracy in the art market. Digital platforms enable investors to access artworks from around the world, breaking down geographical barriers and expanding the market. Moreover, platforms that focus on the ethical and sustainable aspects of art production and trading will gain traction, aligning with broader investor values.

Art investment, once the preserve of a select few, is being revolutionized by digital platforms. These platforms are making art investment more accessible, transparent, and liquid, opening up new opportunities for a diverse range of investors. As technology continues to evolve, the art investment landscape will become even more dynamic, offering innovative ways to engage with and profit from the world of art.

Written by Cherry Fulgar

For more information, contact Imahica Art at +63 917 894 5646, or email thegallery@imahica.art

Imahica Art is a contemporary art gallery in the Philippines, showcasing works by both emerging and established artists. As one of the newer venues in the Philippines, it significantly enhances the diversity and appreciation of contemporary art collections and investments, both locally and globally. Located at the intersection of Lee Street and Shaw Boulevard in Wack-Wack, Mandaluyong City, the gallery is fully accessible and open to the public for free unless otherwise stated.